indiana tax payment history

Search for Indiana tax payment histories. Building A 2nd Floor 2293 N.

1860 Winchester Indiana Randolph County Tax Bill History Ebay

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

. Find Indiana tax forms. Indy Free Tax Prep is a network of Volunteer Income Tax Assistance VITA sites provide through the United Way of Central Indiana that offer free tax preparation to individuals and families with. Your browser appears to have cookies disabled.

Main Street Crown Point IN 46307 Phone. Cookies are required to use this site. The information provided in these databases is public record and available through public information requests.

Most new employers in the state of Indiana start with a 25 unemployment tax rate unless your company is a construction company successor company or a government entity at which. Main Street Crown Point IN 46307 Phone. Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for.

As you begin to type a property location addresses will appear below. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Pay online at Forte Services by credit card or debit card for a convenience fee of 25 or by electronic check for 150. Please note that the property address entry field will auto populate. For all future property tax payments to Delaware County you will need to use our county website codelawareinus and select tax payments you will be able to set up an account for your.

The treasurer settles with. Pay my tax bill in installments. How can I pay my bill.

Otherwise five to ten percent 5 10 penalties will be assessed on any unpaid. Know when I will receive my tax refund. The County Treasurer is the property tax collector and custodian of all monies with responsibility for investing idle funds and maintaining an adequate cash flow.

Property taxes include real property tax parcel tax and. The Department of Local Government Finance has. Indiana tax records are official documents that show a property owners tax payment history in their county.

Find Indiana tax forms. Estimated tax installment payments may be made by one of the following methods. By mail to Clark County Treasurer.

Find Indiana tax forms. Know when I will receive my tax refund.

Oops Here S What To Do If You Missed The Tax Deadline

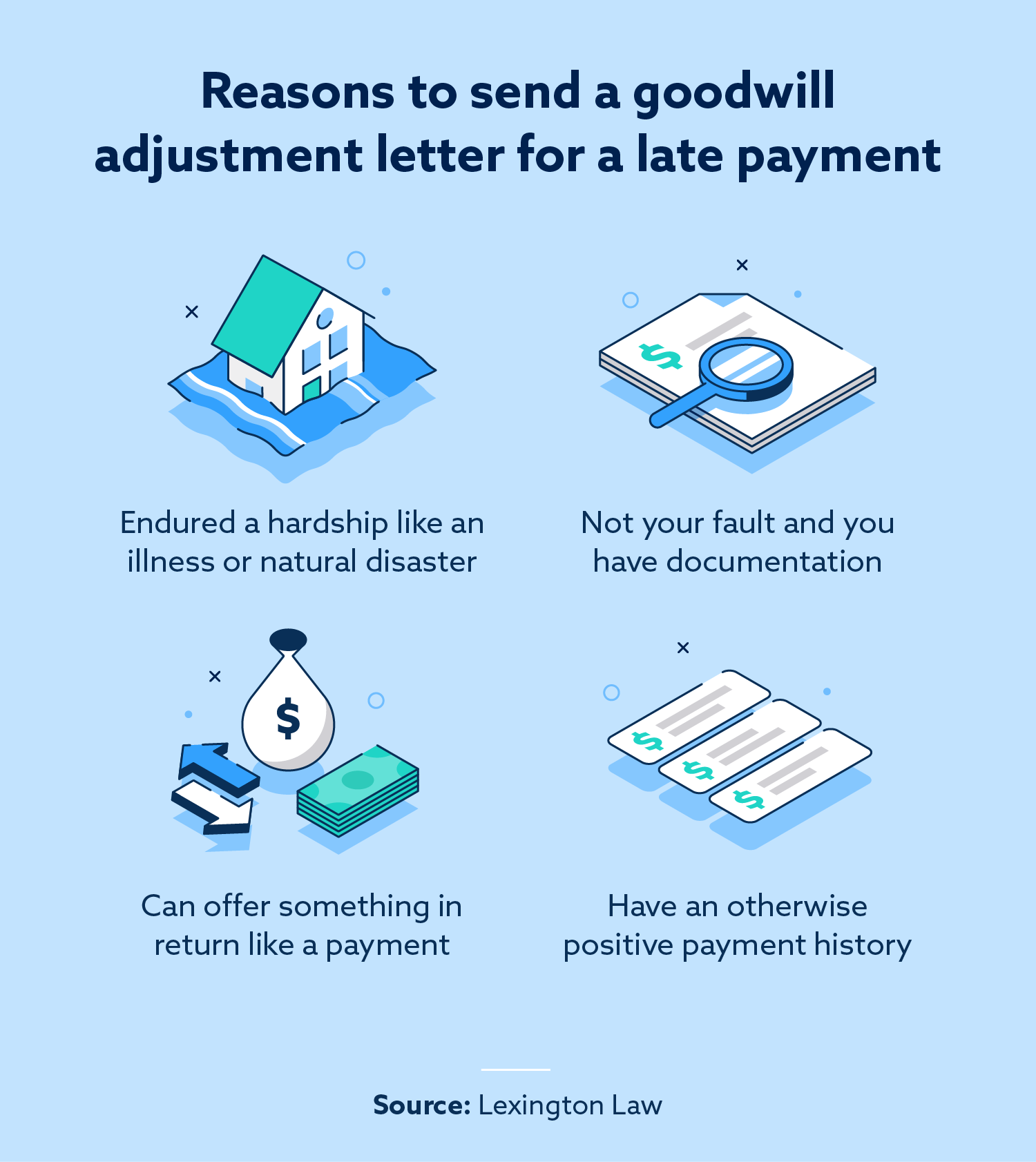

How To Remove Late Payments From Your Credit Report Lexington Law

Advanced Child Tax Credit Could Boost Hoosier Spending By More Than 700m Indiana Public Radio

Indiana Tax Rates Rankings Indiana State Taxes Tax Foundation

Indiana Sees Big Budget Surplus Jump As Tax Refund Eyed Inside Indiana Business

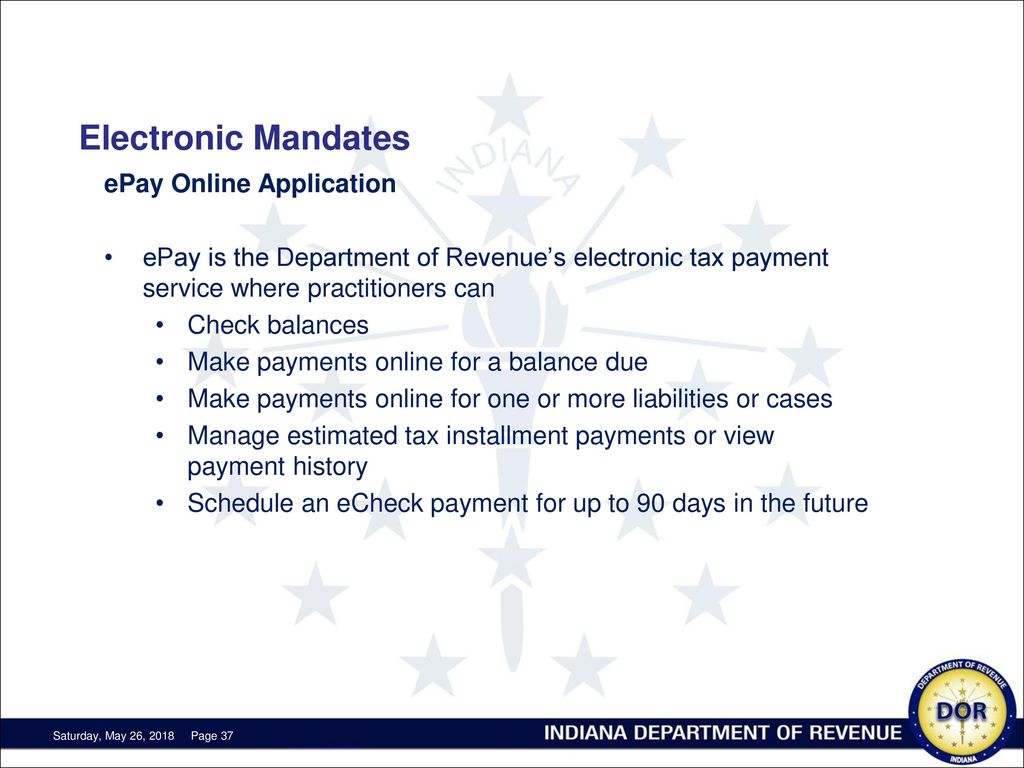

2015 General Update Ppt Download

South Bend Property Taxes Realst8 Com Real Estate And Area Information For South Bend Mishawaka Granger And Notre Dame Indiana

Indiana Gas Tax Burden Dips For September Still Third Highest In State History

Clark County Indiana Treasurer S Office

Indiana State Taxes 2021 Income And Sales Tax Rates Bankrate

Historical Indiana Tax Policy Information Ballotpedia

Form Urt 1 Fillable Current Year Indiana Utility Receipts Tax Return And Schedule Urt 2220

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Dor Indiana Department Of Revenue

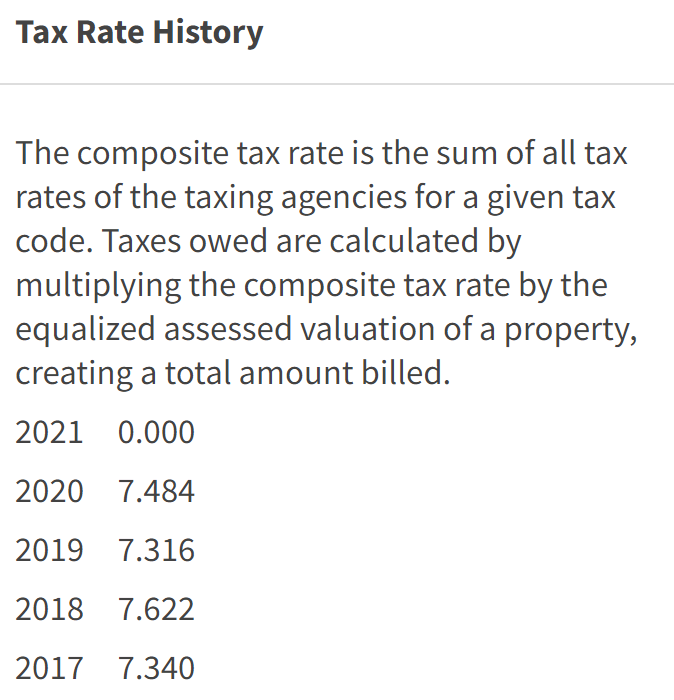

Cook County Property Tax Portal

Dor Unemployment Compensation State Taxes

Study Local Income Tax Rules Could Be Eased Inside Indiana Business